What if budgeting wasn't about restriction - but about permission?

Learn how to budget money with our helpful and easy to understand guide and take control of your financial health. Read on now.

Finally, money that works for you

Early Users Aren't Just Customers.

You're Our Co-Founders.

Finish quick quiz to get insights and how gosavesum can help

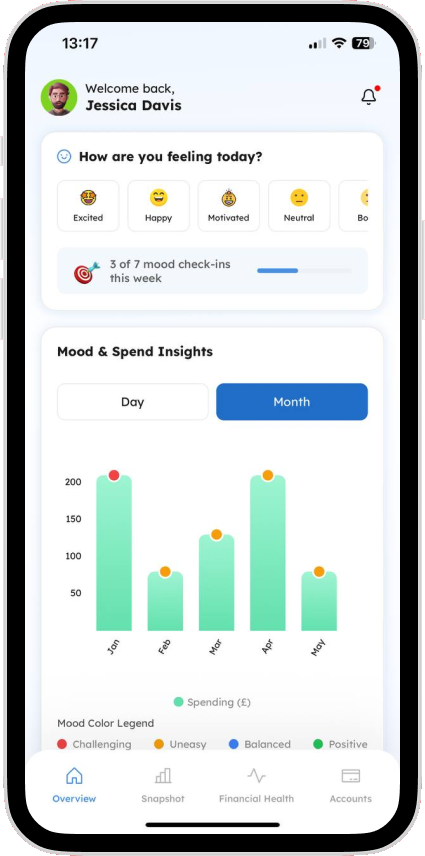

A quick tour of our sleek, user-friendly interface.

Science-backed design that makes managing money feel natural.

Uncover your overspend triggers and get tailored tactics to break the cycle.

Quick assessment to unlock your financial profile.

This quick assessment helps us personalize your experience and provide insights tailored to your unique relationship with money.

Zero hidden fees. Cancel anytime.

Early adopters get 50% OFF - FOR LIFE.

Limited time offer

Reinventing how you manage money with intuitive design and AI.

Our mission is to make financial clarity and confidence second nature, enabling the next generation to not just earn, but thrive. We offer practical support and personalized progress, free from judgment.

Born from real-life money stress, GoSaveSum connects all the dots: budgeting, saving, debt, investing, and personal goals. Our values are confidence, clarity, inclusivity, and progress—with a little fun along the way.

Science-driven insights for smarter money decisions.

🚀 Join the 90-Day GoSaveSum Growth Challenge!